*Private preview. Content subject to change.

Beverage Agencies Don’t Need More Trends.

You need 3 defensible decisions — made for you every Monday.

Your weekly, private, pitch-ready culture-to-digital-commerce decision system:

what to pitch, what to cut, and why — grounded in real commerce data so you walk into every client meeting confident you'll win the room.

Built for senior strategists accountable for what actually ships — to reduce decision risk, not add more opinions.

We review ~30,000 signals weekly. You get the 3 that matter. That's it.

Membership permanently capped at 25 agencies to maintain category exclusivity · Founding cohort now open

What’s Broken:

Beverage Agencies Are Drowning in Trends — But Starving for Clear Activation That Drives Retail Sales.

Every week is chaos — TikTok trends, X chatter, dashboards, partner POVs — but none of it answers the question clients actually ask:

“What should we activate on Amazon, TikTok Shop and creator commerce — and how do we know it'll work?”

The cost is time, credibility, and momentum — as competitors act first.Agencies aren’t short on trends. They’re short on clear, defensible activation they can take into a room with confidence.Partners send decks — not direction. Teams spend hours translating cultural noise into beverage relevance themselves.The problem isn't lack of information. Agencies see thousands of signals every week — social listening, trend reports, search data, eCommerce dashboards. The problem is sustained editorial judgment paired with digital shelf intelligence: filtering tens of thousands of signals to eCommerce plays to the few that are actually defensible, and having the conviction to say no to everything else.And while leadership asks for “culture-driven growth,” there’s no repeatable system to turn that noise into activation ideas that win the room.

What You Get Every Monday

Every week, you receive 3 clear, defensible eCommerce recommendations — what to greenlight on Amazon/TikTok Shop/creator commerce, what to deprioritize, and why — paired with pitch-ready activation slides you can present the same day.

Below: one of the three recommendations from the week ending December 27th Playbook.

Deprioritized Signals

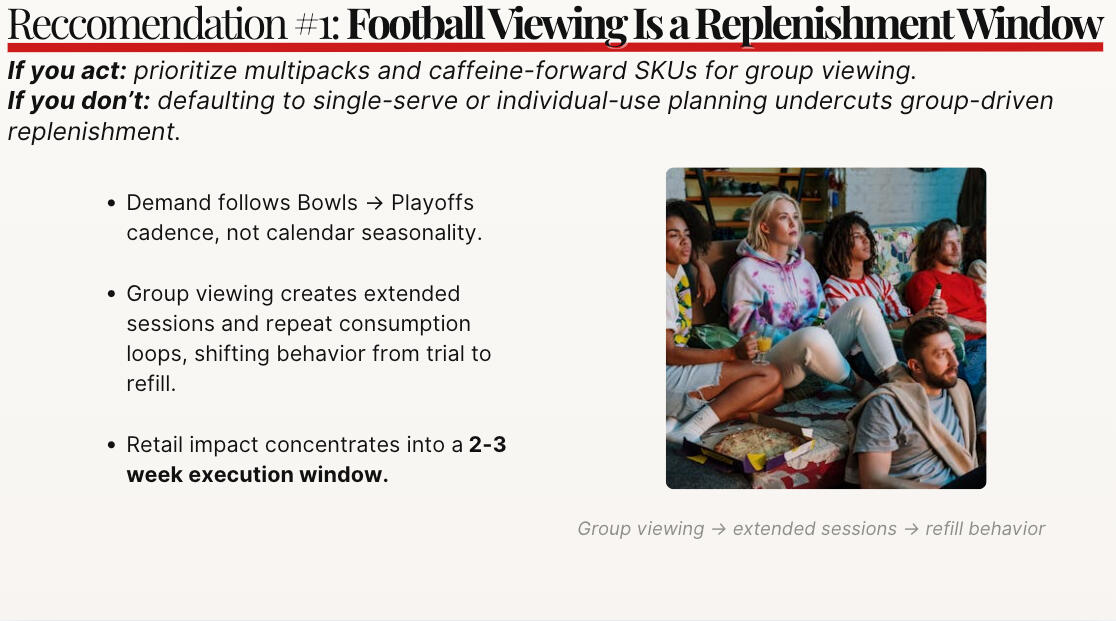

Example Recommendation

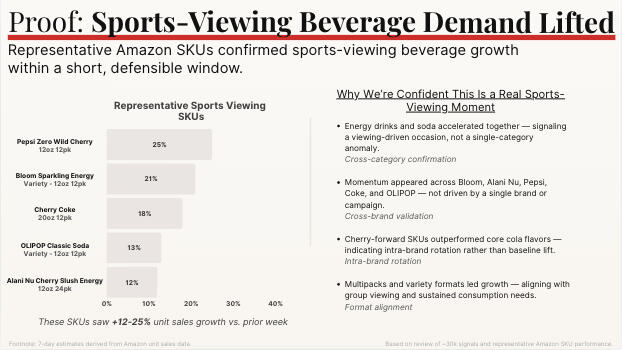

Commerce Proof

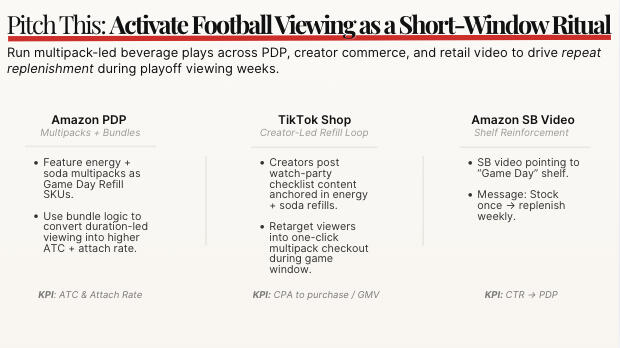

Execution

This is a historical snippet. The full weekly playbook is private, members-only.

Membership permanently capped at 25 agencies · First cohort now onboarding

What Winning Looks Like:

The Weekly Culture-to-Commerce System for Clear Activation.

Imagine starting every week already knowing which cultural shifts will move beverage sales — with the activation plan in hand before client meetings even start.You’re no longer sorting through trends or insights.

You’re reviewing clear, defensible recommendations — backed by real demand and retail data.These recommendations translate directly into what to run, where to run it, and how to execute — across creative, retail, and media — with a clear point of view you can take straight into client rooms.You get:

What to pitch now

What to deprioritize

What to ignore

And for each recommendation, you receive the exact activation blueprint — formats, channels, audiences, and slides — ready to copy, paste, and present the same day.This is your private, embedded strategist — turning culture into confident execution, every week.

The Weekly Decision System

Six components that turn cultural noise into pitch-ready decisions.

Every Monday, we review ~30,000 cultural and commerce signals — then deliver 3 clear decisions: what to greenlight, what to deprioritize, and why.You receive defensible recommendations grounded in cultural and commerce signals driving beverage demand — paired with pitch-ready activation slides you can present the same day.

Demand Signals

1. Core Signals

Real-time curated cultural signals shaping beverage demand — validated by real demand, not hype.

signal vs noise

4. What Not to Chase

Trends lighting up feeds but not driving carts — what not to pitch, and why.

ACTIVATION BLUEPRINTS

2. Activation Blueprints

Client-ready activation plans that translate each decision into exact formats and channels — ready to present the same day.

aisle momentum

5. Weekly Aisle

Weather Map

A fast read on aisle momentum — what’s accelerating, stabilizing, or cooling.

Why It Matters

3. Demand Context

The cultural and audience context behind each decision — why it matters now, not later.

DECK-READY BRIEFS

6. Client-Ready Private Briefs

Everything formatted to drop straight into client decks — no cleanup required.

Delivered alongside the playbook:

Full Playbook deck (PDF)

Polished, client-ready, and presentation-safe — designed to forward, share, or drop straight into a POV without edits.

Editable version of the deck

So teams can copy, paste, or tailor ideas into their own frameworks without friction.

Written weekly brief

(email + mobile-friendly)

A sharp, skimmable narrative summary of the full deck — written to be read before a client call.

Think signal, not sludge.

Occasionally irreverent. Always useful.

Simple "How to Use This" guide

One-pagers covering how recommendations are selected, what each section means, and how agencies typically deploy the playbook in pitches, POVs and planning.

Client Framing One-Pager

(included)

A single-page guide on how to position each recommendation to clients — what to say, what to show, and how to anchor it to business outcomes.

Historical parallels & pattern notes (sent separately, when relevant)

Short, entertaining context pieces connecting one of today's signals to past cycles or cutlural echoes.

We decide, so you don't need to.

Every Monday, clear calls arrive — ready for client rooms.

Membership permanently capped at 25 agencies · First cohort now onboarding

Why We Built The Pulse Playbook

“In CPG, agencies are constantly pressured to improvise — to create winning strategy from chaos: scattered signals, partner decks, and algorithm noise.For years, strategists have been expected to figure it out without real cultural clarity tied to retail proof — then rebuild activation plans and presentations clients could actually trust. That’s a hard way to win.After years in CPG strategy rooms, I built The Pulse Playbook to fix that — giving agencies early clarity, strong recommendations grounded in retail reality, and clear decisions they can stand behind in the room, without lifting a finger."We review ~30,000 signals weekly. You get the 3 defensible recommendations. That's the entire system.

— Joe, CPG Strategist & Creator of Pulse Playbook

You’re Spending How Much?

Beverage agencies quietly pour six figures a year into dashboards, partner decks, social listening, and generic culture reports — and still can’t get clear, defensible recommendations clients can trust.This isn’t a people problem — it’s a tooling problem. The tools agencies rely on weren’t built to produce clear calls at the speed beverage requires today.The Pulse Playbook isn't another over-priced dashboard. It's a private decision playbook for agencies who want to stay ahead of the market.

Why Agencies Can't Build This Internally

Most beverage agencies have tried building this internally—a weekly trend brief, a standing culture sync, a strategist assigned to "own" it.It starts strong. Then the strategist gets pulled into client work. Quality slips. Meetings get rescheduled. By month three, nobody's reading it.But even if your team had the time, they don't have the infrastructure or the judgment.We ingest ~30,000 cultural signals weekly—social listening, search trends, emerging conversations—then leverage our proprietary methodology to validate them against SKU-level Amazon sales data, identifying which signals are actually driving digital commerce, not just attention. This isn't algorithmic—it's human curation, refined through years of CPG strategy work analyzing activations to know what moves retail vs. what just trends.The Pulse Playbook works because this is our only job, and we've built the infrastructure to support sustained human judgment. You get the output. We handle the discipline, the data validation, and the curation.

We're For

Agencies Who...

Real-Time Signals

Want weekly, real-time cultural signals tied to category velocity — translated into clear digital shelf plays before competitors react.

Weekly Activation

Value simple, clear activation angles in client-ready slides — ready to pitch every Monday.

Lightweight Systems

Need a lightweight, done-for-you weekly system — no setup, no dashboards, no maintenance.

Human Tone

Appreciate real humans, a little humor and zero corporate theater.

We're Not For Agencies Who...

Broad Trends

Prefer quarterly trend decks and macro analysis.

Deep-Dive Exploration

Prefer long, exploratory insight decks or dashboards without clear activation.

Bespoke Service Models

Need bespoke client service teams or expansive enterprise platforms.

Formal Corporate Style

Prefer a formal, buttoned-up corporate style and heavy process.

Membership & Guarantee

Your risk-free guarantee

Your Risk-Free Guarantee

If we don’t help you land a client win—or materially improve pitch confidence—within your first 30 days, you get 100% of your money back. No questions asked.If we do help you win—and we will—you get your next month free.

Founding member offer

Founding Member Pricing

$1,000/monthOne strong idea sold into a client relationship often pays for the subscription many times over.What founding members receive:

Replaces weekly internal debate and second-guessing — not just research time.**

Weekly Delivery (every Monday by EOD).

Private, slide-ready recommendations you can drop directly into client decks — before competitors know they exist. Membership is capped to maintain quality and edge.

Direct influence over playbook's evolution — founding members shape what comes next.

Cancel Anytime. If this doesn’t become part of how your team decides, cancel.

Membership permanently capped at 25 agencies · First cohort now onboarding

FAQs

Quick Summary:The Pulse Playbook gives beverage agencies weekly, clear decisions on what to pitch, what to prioritize, and how to activate—grounded in real cultural and retail demand, delivered in client-ready slides.

Pitch velocity

1. Will this actually help us win pitches?Yes. The Playbook is engineered for pitch velocity — giving your team early, defensible recommendations—grounded in retail demand and translated into pitch-ready activation angles you can build into decks the same day.

Agencies use these insights to sharpen POVs, anchor ideas in real demand, and walk into rooms with clarity competitors can’t match.

Time to value

2. How long does it take to use?Under 10 minutes.

The Playbook is intentionally lightweight — designed for agencies who ship weekly and need fast, frictionless clarity.

3. What kinds of decisions does the Playbook actually make?Each week, the Playbook makes clear calls on what to pitch now, what to deprioritize, and how to activate — spanning creative direction, retail execution, and channel prioritization — all grounded in where culture is translating into real demand right now.

weekly playbook delivery

4. What exactly do I get every Monday?Each weekly drop includes:

Three clear cultural execution recommendations shaping beverage demand

Retail movement proof showing what consumers are actually buying

Audience + platform context to make the signal land

Client-ready activation slides you can drop straight into decks

What Not to Chase and a weekly aisle forecast

Everything is built for speed, clarity, and immediate use.

Data Quality and Validation

5. How reliable are the recommendations?Every weekly recommendation is grounded in cross-validated data including:

Category-specific retail movement across major commerce channels — including Amazon SKU-level data.

Social virality patterns

Search intent trends

This triangulation removes false positives so you’re seeing what’s actually shaping demand — not algorithm noise or generic “culture trends.” This keeps the Playbook grounded in what actually moves revenue — not what merely looks hot.

6. How many recommendations do we receive each week?Each week, the Playbook delivers the strongest 1-3 actionable, defensible recommendations, depending on what’s actually moving in-market (typically 3).We don’t force volume. We prioritize clarity over count. Some weeks, one clear opportunity beats three weak ones.Every drop also includes a What Not to Chase section — so teams know what to ignore just as confidently as what to pitch.

7. Do you look back to see if recommendations actually performed?Yes. Internally, we run post-mortems on signals 3–6 weeks after publication to pressure-test whether they translated into real movement and activation impact — not just attention.This discipline helps refine what we ship next and keeps the Playbook grounded in what actually drives demand, not what merely looks hot — evolving our system based on what proves durable in-market.

8. Do you cover physical retail activation (c-stores, gas stations, etc.)?The Playbook focuses on digital commerce activation—Amazon, TikTok Shop, creator commerce, and digital shelf strategy. This is where we have proprietary SKU-level data that most agencies don't access, and where your strategic influence creates the most leverage. Physical retail (c-stores, QSRs) sees similar demand patterns during cultural moments, but that's table stakes your team already knows how to activate.

stack compatibility

9. What if my team already uses dashboards and culture reports?Great — this works alongside them.

Dashboards tell you what happened. The Playbook tells you what’s happening next, why it matters for beverage, and how to activate against it.

client-ready application

10. Can we use these recommendations directly in client work?Yes — that’s the point.

Every slide is formatted to be client-ready, editable, and drop-in-ready for briefs, concept reviews, pitch materials, or POVs.

Members routinely use the Playbook to strengthen weekly deliverables and accelerate creative development.

Audience Fit

11. Who is this for?The Beverage Pulse Playbook is built for strategists, operators, and senior leaders who need weekly real-time cultural clarity tied directly to retail velocity — with activation angles in client-ready presentations.

Not another sweep of broad macro trends or dashboard noise.

usage and workflow fit

12. What if my team doesn’t use it consistently?Each drop takes only a few minutes to review and is designed to slot directly into briefs, concepts, or client decks.Because it removes decision friction, most teams tell us it quickly becomes a Monday ritual — not another task.

product model

13. Is this custom work or a SaaS tool?Neither.

It’s a done-for-you weekly intelligence system — no portals, no dashboards, no setup, no learning curve. Just actionable clarity.

Category Scope

15. Which beverage categories do you cover?Our hierarchy mirrors Amazon’s Beverage aisle, focusing on the full category landscape.

Signals are category-tight, meaning each week highlights movements that matter to beverage strategists and operators.

exclusivity

14. Will my competitors get this too?Access is limited to 25 agencies to maintain category sharpness and prevent broad circulation.

When too many teams use the same signals, they lose their edge — and that defeats the purpose.

membership terms

16. What’s the commitment?Month-to-month. Cancel anytime.We built this to make decisions easier. If it doesn’t do that for you, you shouldn’t keep it.

risk-free guarantee

17. What if we don’t get value?You’re covered by a 30-day, no-questions-asked refund if we don't help you land a client win.

And better, when we do help you win, your next month is on us.

pricing logic

18. Why $1,000/mo?Because the Playbook replaces:

Expensive dashboards

Slow culture reports

Manual trend synthesis

Activation concepting

…and gives beverage agencies a weekly competitive edge their competitors won’t see coming. It's your private embedded strategist every Monday.Most agencies recoup the cost (and much more) with a single pitch win.

Delivering an excellent product at a fair price feels right to us.

setup and adoption

20. What does onboarding look like?There’s no setup.

No portal.

No training.

You subscribe, and your first weekly drop arrives the next Monday — formatted so your team can use it immediately.

Most strategists are fully operational in under 5 minutes.

Differentiation and Signal Quality

21. What makes these recommendations different?Every recommendation is private, category-tight, and activation-ready — validated across social virality, search intent, and real retail movement.

These recommendations and briefs don’t appear on social media, in partner decks, dashboards, or public trend reports. They live between us, and you.

exclusivity and signal sharpness

22. Why is access limited to 25 agencies?To keep the signals sharp, category-tight, and exclusive.

When too many teams use the same insights, the edge disappears — and this product is built to protect yours.

team access

23 & 24. Can multiple people on my team access it? Can I share this internally?Yes. Founding Members can share the weekly Playbook internally.

Teams aren't members because of the insights — but because decision-making gets easier every week.

Membership permanently capped at 25 agencies